Blog

Your go-to resource for Optiml updates, tax insights, case studies, and the latest news to help you optimize your financial future.

Max Value, Max Spend, or Set Value: Choosing the Retirement Strategy That Fits Your Life

Retirement isn’t one-size-fits-all. Whether you want to grow your estate, maximize enjoyment, or balance both, your strategy should reflect your values.

Max Jessome

6 min read

February 13, 2026

Speculation vs. Substance: What the Recent Market Drop Reminds Us About Investing

Bitcoin crashed, tech stocks pulled back, but long-term wealth still comes from boring, productive, diversified assets.

Max Jessome

5 min read

February 5, 2026

Why More Canadians Should Consider a Partial RRSP-to-RRIF Conversion Before 71

The default retirement path isn’t always the smartest one, flexibility, control, and long-term outcomes matter more than rules of thumb.

Max Jessome

6 min read

January 30, 2026

The Hidden Cost of Upgrading: Why Your “Cute” House Might Be the Smarter Play

Bigger homes don’t always mean better lives. Sometimes the smallest house builds the biggest freedom.

Max Jessome

5 min read

January 23, 2026

The Age 45 Financial Check-In: Are Your RRSP and TFSA Balances 'Normal'?

At 45, the 'procrastination window' is closing. Here is how your savings stack up against the national averages and the benchmarks you should actually be aiming for.

Max Jessome

6 min read

January 16, 2026

Yes, Taxes Suck — But Dying With Millions and Regret is Worse

Avoiding taxes shouldn’t come at the cost of your lifestyle. Here’s why spending your money wisely, even if it means paying some tax can lead to a more fulfilling retirement.

Max Jessome

5 min read

January 9, 2026

Navigating 2026: Your Guide to Canada's New Tax Landscape

Federal Cuts, Provincial Adjustments, and What It All Means for Your Wallet

Alex Ingham

7 min read

January 2, 2026

What Canadians Are Really Thinking About Their Money Right Now

Money behaviour shifted this winter. Canadians saved more, spent less, and focused on paying down debt. But uncertainty remained high. Here's what's driving the change.

Zac Davies

7 min read

December 26, 2025

Year-End Financial Moves Canadians Should Review Before January

Before the calendar flips, there are a few financial decisions that can permanently impact your taxes, contribution room, and long-term outcomes.

Max Jessome

6 min read

December 19, 2025

.png)

Running the Numbers Before You Retire

Approaching retirement without a tested plan? Here's why running the numbers now, and stress-testing them, could be the most important thing you do before you stop working.

Zac Davies

7 min read

December 12, 2025

New Business Owner Features in Optiml: Trusts, HoldCos, OpCos & More

Optiml just launched its biggest update yet for incorporated Canadians. Here’s how to plan, optimize, and simulate your entire corporate structure, from Family Trusts to HoldCos to OpCos, all in one place.

Max Jessome

7 min read

December 5, 2025

Premier Tim Houston Visits Optiml: A Win for Nova Scotia’s Innovation Ecosystem

A look inside Premier Tim Houston’s visit to Optiml HQ, and the incredible provincial support that’s helping fintechs like ours thrive in Nova Scotia.

Max Jessome

5 min read

November 28, 2025

The End of Manual Data Entry? How Open Banking Will Transform Tools Like Optiml

Canada’s open banking framework is finally moving forward. Here’s how it could reshape tools like Optiml and make financial planning faster, easier, and more accurate.

Max Jessome

7 min read

November 21, 2025

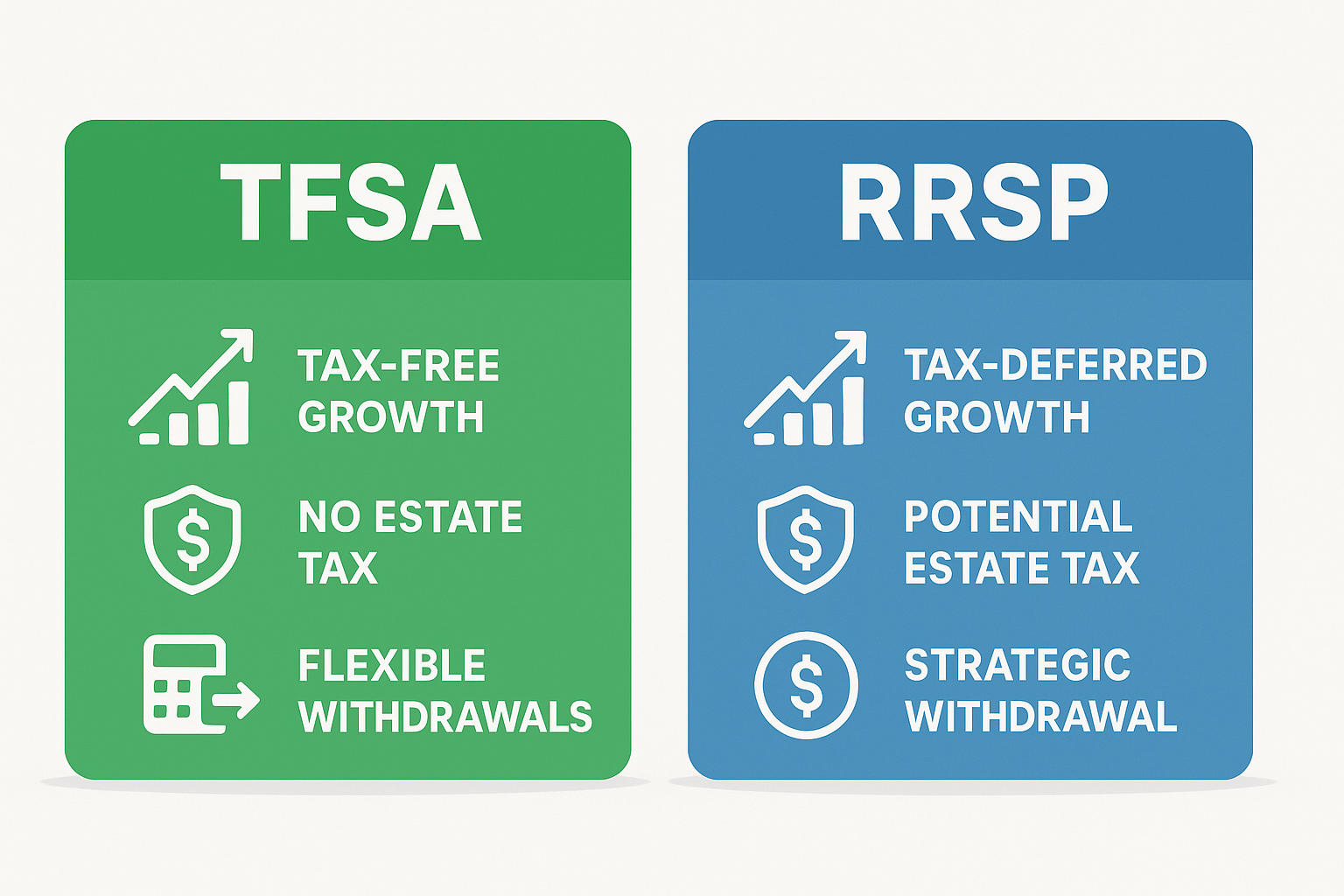

Should You Max Out Your TFSA Every Year?

This common advice sounds like a no-brainer, but real-world planning shows that always maxing your TFSA isn’t always optimal. See how different strategies compare using Optiml.

Max Jessome

8 min read

November 14, 2025

Should You Realize Capital Gains Every Year?

Explore the impact of realizing capital gains gradually versus deferring them, and how Optiml now lets you model both strategies with precision.

Max Jessome

7 min read

November 7, 2025

Frequently Asked Questions About Optiml

Get answers to the most common questions we've been asked about using Optiml to plan your financial future.

Zac Davies

8 min read

October 31, 2025

Build Your Retirement Safety Net: Why Every Retiree Needs a Cash Wedge

When markets dip, your retirement shouldn't. A cash wedge gives you the confidence to stay invested, spend comfortably, and protect your plan from short-term volatility.

Max Jessome

8 min read

October 24, 2025

Compare Plans: The Smartest Way to See How Every Decision Impacts Your Future

Retire at 63 or 65? Downsize or keep your home? Optiml’s new Compare Plans feature lets you see both paths side by side and understand what really changes.

Max Jessome

7 min read

October 17, 2025

Stop Feeling Guilty and Spend More in Retirement!

The industry taught you to save forever. Optiml shows you how to spend confidently with tax-smart decumulation and real stress testing.

Max Jessome

6 min read

October 10, 2025

The Hidden Risk in Retirement: Why the Sequence of Returns Matters More Than the Average

Two portfolios with the same average return can end in completely different places once withdrawals begin. Optiml shows you how to stress test your plan against this silent risk.

Max Jessome

7 min read

October 3, 2025

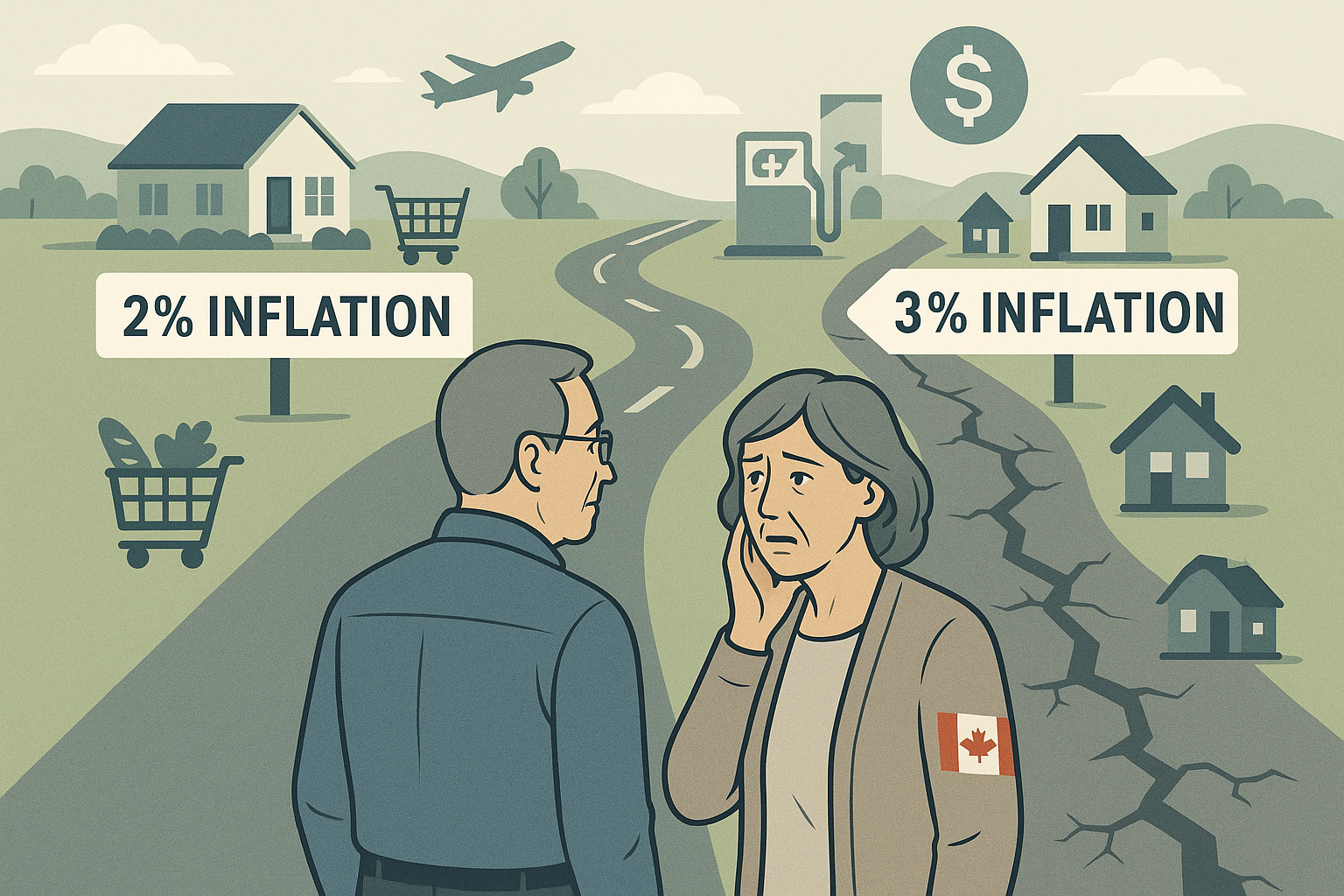

The Silent Threat to Your Retirement: Why a 1% Change in Inflation Could Shrink Your Estate by Half

Small differences in inflation, 2% vs. 3% can drastically change your spending power, estate value, and retirement lifestyle. Optiml helps you see the impact before it’s too late.

Max Jessome

6 min read

September 26, 2025

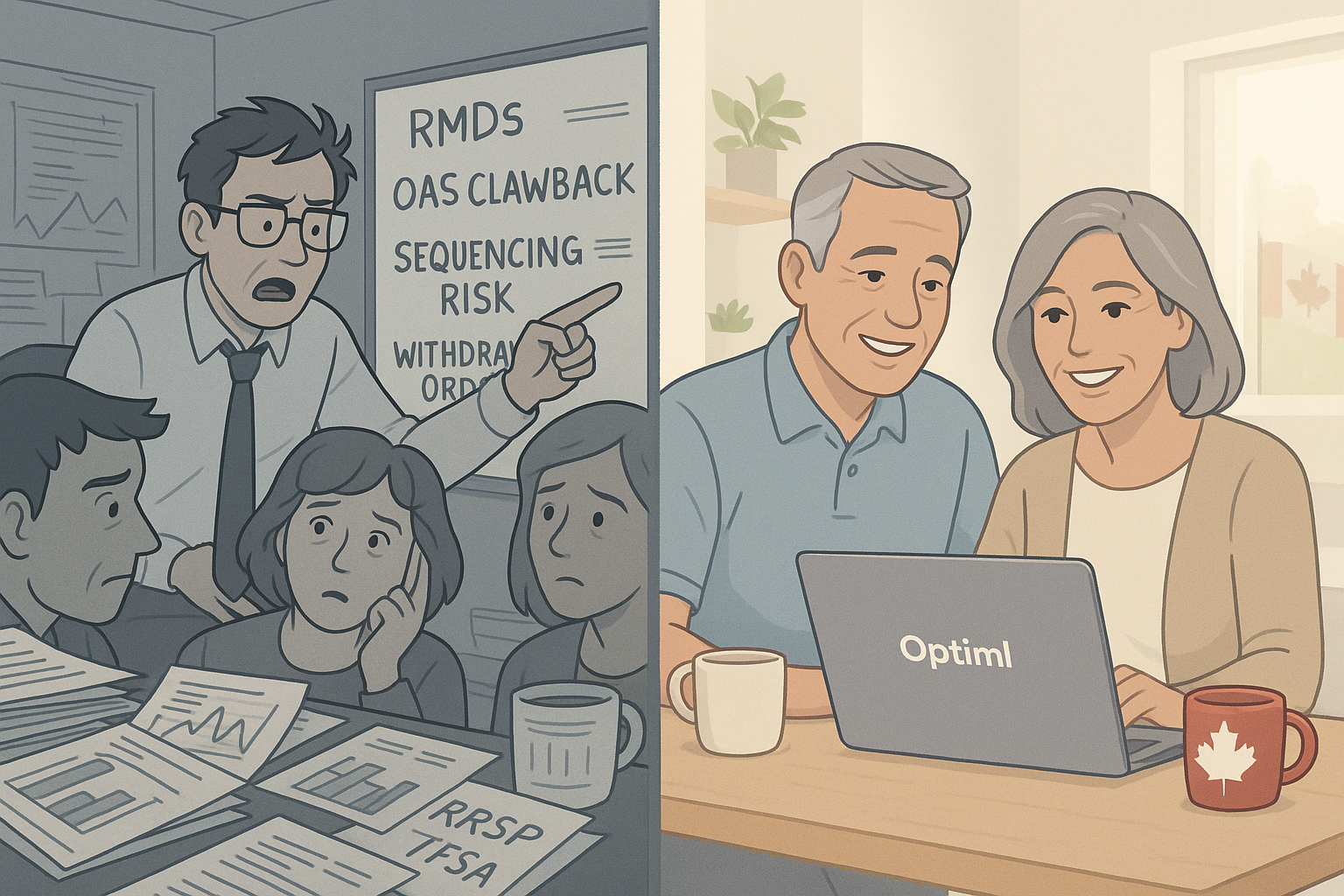

Retirement Planning Isn’t Hard, the Industry Just Makes It Sound That Way

Forget jargon. Optiml shows you how to retire confidently by running the math behind CPP, RRSPs, taxes, and spending, with or without an advisor.

Max Jessome

7 min read

September 19, 2025

Pay Off Your Mortgage or Invest? Eva’s Surprisingly Nuanced Answer

Optiml’s in-app AI Model Eva, breaks down the real trade-offs, risk vs. certainty, tax treatment, and time horizon so you can choose with confidence.

Max Jessome

6 min read

September 12, 2025

.png)

One Year of Optiml: Building Through Challenge, Change, and Community

Reflecting on our first year building Optiml from zero customers to a thriving community of DIY financial planners.

Zac Davies

8 min read

September 5, 2025

OAS Clawback: Should You Really Avoid It at All Costs?

For many Canadians, avoiding OAS clawback becomes the entire retirement strategy, but that mindset can lead to lower income, smaller estates, and bigger long-term tax bills. Here's what actually matters.

Max Jessome

6 min read

August 29, 2025

LIRA Rules Are Changing And It's About Time

More provinces are allowing LIRA unlocking, including Nova Scotia, and it’s a welcome move toward giving retirees more control, flexibility, and better tax outcomes.

Max Jessome

6 min read

August 22, 2025

What 29 $5-Million TFSAs Tell Us About Wealth, Risk, and the Real Power of Tax-Free Investing

Only 29 Canadians have managed to grow a TFSA beyond $5 million, here’s how they did it, and what the rest of us can learn about smarter tax and retirement planning.

Max Jessome

5 min read

August 15, 2025

What 500 Canadians Told Us About Retirement Planning in 2025

Survey insights reveal how Canadians feel about retirement, their top goals, and the biggest planning mistakes to avoid.

Max Jessome

5 min read

August 8, 2025

Why Canada’s Tech Growth Matters for Your Retirement Plan

How a surging tech sector could reshape your portfolio and your retirement strategy.

Max Jessome

5 min read

August 1, 2025

Can You Retire with $1 Million in Canada?

A real-life example of how Optiml can help you make sense of it.

Max Jessome

5 min read

July 25, 2025

AI and the Future of Financial Planning

Smarter Advice for a Complex World

Max Jessome

7 min read

July 18, 2025

Can You Spend More in Retirement?

How thousands of Canadians are discovering they can spend more confidently and still leave behind a strong legacy.

Max Jessome

7 min read

July 11, 2025

What I Learned Meeting Our Most Engaged Users

Insights from connecting with our Super Users and what they really value about Optiml

Zac Davies

6 min read

July 4, 2025

Why You Need to Stress Test Your Financial Plan

Because the real world doesn't follow spreadsheet assumptions

Max Jessome

4 min read

June 27, 2025

A Helpful Conversation with an Optiml User

Real Questions, Real Answers - What Every Canadian Should Know About Financial Planning

Zac Davies

4 min read

June 20, 2025

Open Banking in Canada

What It Means for You

Zac Davies

3 min read

June 13, 2025

Canada's Federal Tax Rate Is Dropping

Here's What It Means for Your Plan

Alex Ingham

3 min read

June 6, 2025

Why Diversification Still Matters

The Case for a Balanced Portfolio at Every Life Stage

Max Jessome

5 min read

May 30, 2025

Building a Fintech Company in Atlantic Canada

The Challenges, The Momentum, and The Vision Ahead.

Max Jessome

5 min read

May 23, 2025

The Silent Stress in Retirement: Why Decumulation Anxiety Is Keeping Canadians Up at Night

It's not about whether you've saved enough. It's about whether you're doing the right things with what you've saved.

Zac Davies

5 min read

May 16, 2025

In a Housing Market This Uncertain, Planning Is Essential

For most Canadians, homeownership has long been more than a financial milestone.

Alex Ingham

5 min read

May 9, 2025

Dividend Investing in Canada

Why Canadian Investors Love Dividends - And What You Should Know

Max Jessome

5 min read

May 2, 2025

Retirement Spending Isn't Flat

Retirement Spending Isn't Flat - And Your Plan Shouldn't Be Either

Max Jessome

4 min read

April 25, 2025

What Is a CCPC?

A Guide for Canadians Looking to Build Wealth the Smart Way

Max Jessome

5 min read

April 18, 2025

Maximizing Estate Value vs. Minimizing Lifetime Taxes

A Strategic Tradeoff in Retirement Planning

Zac Davies

4 min read

April 11, 2025

Introducing Custom Plan

Because Life Doesn't Always Follow the Math.

Max Jessome

4 min read

April 4, 2025

Retirement Reality Check: How Canadians Are Rewriting the Rules in 2025

Alex Ingham

3 min read

March 28, 2025

Canadians Are Demanding Financial Clarity - And It's About Time

Zac Davies

7 min read

March 21, 2025

How Much Do I Need to Retire in Canada?

Zac Davies

5 min read

March 14, 2025

Navigating Uncertainty

How Canadians Are Taking Control of Their Financial Future.

Max Jessome

3 min read

March 7, 2025

Market Volatility

The Power of Long-Term Planning.

Max Jessome

3 min read

February 28, 2025

The Great Wealth Transfer

How to Plan Wisely and Minimize Taxes on Your Inheritance.

Max Jessome

4 min read

February 21, 2025

Why Is It So Hard to Find Financial Information in Canada?

A look at the challenges Canadians face when trying to find financial information.

Alex Ingham

4 min read

February 14, 2025

Capital Gains Inclusion Rate

What the Rollback Means for You

Max Jessome

5 min read

February 7, 2025

Goal-Based Financial Planning with Optiml

A Smarter Path to More Wealth

Max Jessome

5 min read

January 31, 2025

CPP and OAS

Should You Start Early, On Time, or Late?

Max Jessome

4 min read

January 24, 2025

Why Optiml and Why Now

Navigating the Modern Canadian Financial Landscape

Max Jessome

4 min read

January 17, 2025

New Contribution Limits and Capital Gains Tax Changes

Navigating Canada's 2025 Financial Landscape

Max Jessome

6 min read

January 10, 2025

Introducing the Optiml Blog

Welcome to the Optiml Blog, where we'll share insights, strategies, and expert advice to help you optimize your financial future.

Max Jessome

6 min read

January 3, 2025

© 2026 Optiml. All rights reserved.